May 11, 2016

Norway Increases Oil Wealth Spending to Ward Off Recession. Norway’s government boosted the amount of oil money it will spend this year to a record, dipping deeper into its sovereign wealth fund to ward off a recession. The government will use 205.6 billion kroner ($25 billion) of its oil wealth, up from the 195.2 billion kroner it estimated in October, according to the budget released in Oslo Wednesday. The spending will have a stimulus effect of 1.1 percentage point, which is the most since 2009 and up from 0.7 percentage point in the initial budget.

“A key priority for the government in the current situation is to support growth and employment in sectors exposed to international competition,” Finance Minister Siv Jensen said in a statement. “Tax reform with lower taxes and increased spending on education and infrastructure, is essential in this respect.”

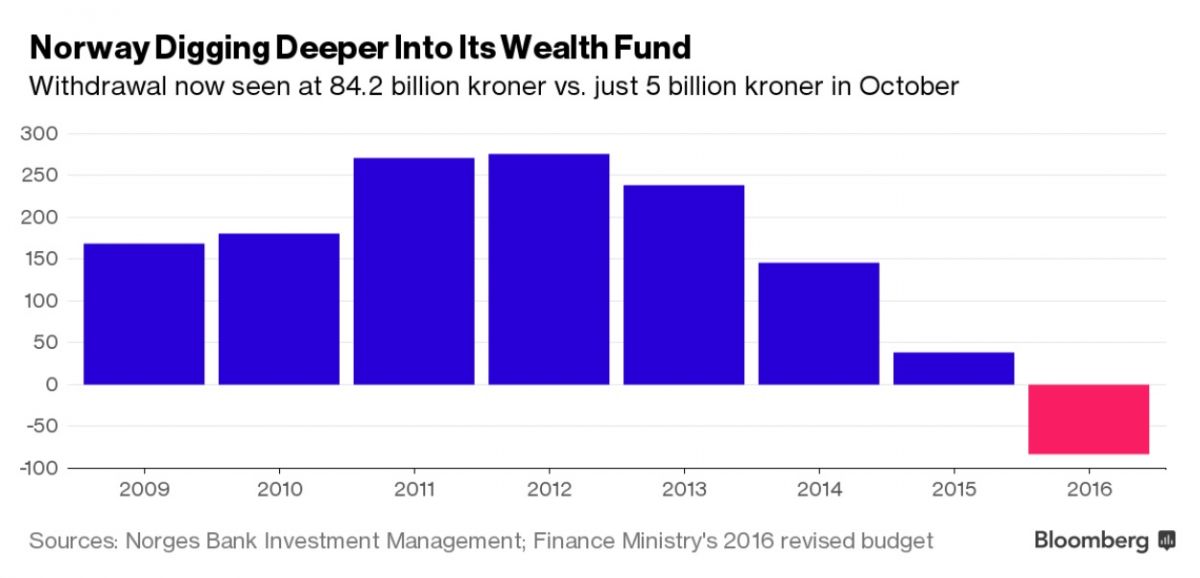

The added spending means the government plans to withdraw 84.2 billion kroner from its 7 trillion kroner wealth fund. That’s up from an October estimate of just 4.9 billion kroner, made before oil plunged at the end of last year, and higher than the 80 billion kroner estimate made by the fund in February. At the same time as spending increases, the government’s cash flow from oil and gas production is expected to drop by almost 40 percent to 132 billion kroner this year.

The plunge in crude prices is squeezing the economy of western Europe’s biggest oil producer, driving up unemployment and threatening to halt growth. The central bank in March cut rates to a record low of 0.5 percent and signaled it was prepared to ease further to avoid an outright recession.

According DNB ASA, Norway’s largest bank, the expansionary budget will cool the need for more rate cuts from the central bank.

According DNB ASA, Norway’s largest bank, the expansionary budget will cool the need for more rate cuts from the central bank.

“Increased fiscal stimulus damps the need for interest rate cuts,” said Jeanette Stroem Fjaere and Kyrre Aamdal, analysts at DNB Markets. “Norges Bank will probably not refrain from a cut to 0.25 percent, but the chance of a zero interest rate is significantly weakened.”

The increasing “oil deficit” will also mean bigger krone purchases by Norges Bank during the year, they said. The bank has been converting foreign currency income to kroner to hand over to the government.

The government cut its forecast for mainland economic growth this year to 1 percent and said it sees an expansion of 1.7 percent next year. The price of oil will be 346 kroner ($42) per barrel this year, compared with an earlier forecast of 474 kroner, and 396 kroner next year. Unemployment will rise to 4.7 percent this year from 4.4 percent in 2015.

The minority government needs backing from the smaller Liberal Party and the Christian Democrats to pass the budget.

While the increase in oil-wealth spending is necessary to stimulate the economy, more funds should be allocated to reduce unemployment, the Christian Democrats said in a press release. The Liberals criticized the “record oil-money spending” and said it would push to strengthen climate-friendly growth.

The Labor Party, the biggest opposition group in parliament, said the budget was “too little, too late against record unemployment.”

“I fear we’re heading into a negative spiral, where the income base is weakened through tax cuts, unemployment rises and increasingly more money has to be taken from the oil fund,” Marianne Marthinsen, a Labor lawmaker in charge of financial issues, said in a statement.